Carbon Asset Risk Assessment

Hess has reviewed the International Energy Agency’s (IEA's) three key scenarios detailed in the 2024 World Energy Outlook (2024 WEO) – the Stated Policies Scenario (STEPS), the Announced Pledges Scenario (APS) and the Net Zero Emissions by 2050 Scenario (NZE) – and compared them with the prior versions of these scenarios in the 2022 World Energy Outlook, which were the basis of our 2023 carbon asset risk assessment. While we acknowledge that the 2024 WEO reflects lower oil prices than the 2022 WEO, based on Hess’s updated pricing and portfolio assumptions, an updated carbon asset risk assessment would have produced a favorable outlook for the company, similar to our 2023 analysis. Based on these assumptions, the overall conclusions from our 2023 analysis remain relevant. Specifically, we can conclude that we would be able to produce our current reserve base under the STEPS and the APS, with no stranded volumes. If we see indications that the world is moving along the NZE pathway, a normative scenario that reflects a narrow pathway for the global energy sector to achieve net zero emissions by 2050, we would expect to optimize our development plan and overall business strategy to maximize cash margins. Please see our carbon asset risk assessment, based on the 2022 WEO, for reference below.

Carbon Asset Risk Assessment from Hess’ 2022 Sustainability Report

Note: The following carbon asset risk assessment was completed in early 2023 and was originally published in Hess’ 2022 Sustainability Report , published in June 2023.

Hess conducts scenario planning to assess portfolio resilience over the longer term in order to help understand climate related risks and opportunities – and to provide perspectives to our investors and other key stakeholders on how Hess’ oil and gas portfolio might be impacted by a transition to a lower carbon economy. This scenario based approach enables us to assess and communicate to our shareholders our understanding of future risks and opportunities in relation to the potential evolution of energy demand, energy mix, the emergence of new technologies and possible changes by policy makers with respect to greenhouse gas (GHG) emissions.

Hess conducts scenario planning to assess portfolio resilience over the longer term in order to help understand climate related risks and opportunities – and to provide perspectives to our investors and other key stakeholders on how Hess’ oil and gas portfolio might be impacted by a transition to a lower carbon economy. This scenario based approach enables us to assess and communicate to our shareholders our understanding of future risks and opportunities in relation to the potential evolution of energy demand, energy mix, the emergence of new technologies and possible changes by policy makers with respect to greenhouse gas (GHG) emissions.

Hess has chosen to model the three key scenarios detailed in the IEA’s 2022 WEO against our own internal base planning case. This is in accordance with the TCFD’s recommended transparency around key parameters, assumptions and analytical choices. The TCFD recommends that organizations use at least one scenario in which global warming is kept to well below a 2°C increase during this century, compared with preindustrial levels, to test portfolio resilience. Such scenarios usually feature a reduction in demand for oil, natural gas and coal and a growth in clean technologies. The APS and the NZE, which are included in the 2022 WEO and are part of Hess’ modeling, fit with this recommendation.

Considerations for Carbon Risk Scenario Assessment

To evaluate the potential exposure of our portfolio in a carbon constrained future, we begin by considering the long range outlook for energy supply and demand, as well as for oil, natural gas and carbon prices. We use the 2022 WEO to examine energy supply and demand and oil, natural gas and carbon price scenarios through 2050 within the STEPS, the APS and the NZE (see iea.org/reports/world-energy-outlook-2022). Use of these scenarios is recognized as a leading industry standard and benchmark worldwide, and they are, therefore, an appropriate choice for an oil and gas producer such as Hess. The IEA has several views on how the energy system might evolve; therefore, these scenarios are not considered to be forecasts.

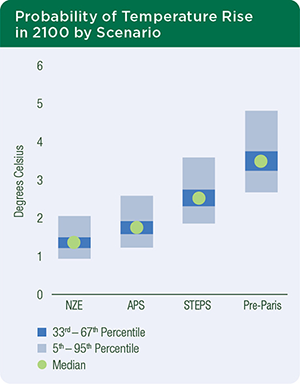

An important consideration when reviewing the results of our scenario analysis is that the NZE is considered a normative scenario, which means that it is designed to achieve a specific outcome – a 1.5°C or lower rise in temperature by 2100 – and works backward from the outcome to achieve its objective, even though the pathway to reach this result may be a narrow one. The APS assumes that all aspirational targets announced by governments and companies are met on time and in full, including their long term net zero emissions and energy access goals. The STEPS is an exploratory scenario, in that it does not target a specific outcome, but rather establishes a set of starting conditions and considers where they may lead.

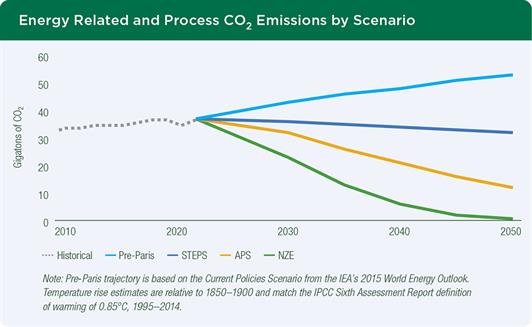

The charts below depict the 2022 WEO’s world energy demand and CO2 emissions under the IEA’s three key scenarios.

The IEA refers to the gap in CO2 emissions reductions between the STEPS and the APS as the “implementation gap,” meaning the gap that needs to be filled to realize commitments in full. The gap between the APS and the NZE is called the “ambition gap” because it refers to the collective pledges made to date that are not ambitious enough to match the goal of a 1.5°C stabilization in global average temperature by 2100. The gap in CO2 emissions reductions between the APS and the NZE in 2030 is twice as large as the gap between the STEPS and the APS, highlighting the magnitude of the unmet global ambition by 2030 to reach NZE objectives (2022 WEO).

In the STEPS, which is consistent with enacted energy policies and a pragmatic view of proposed policies, global energy demand is expected to grow by approximately 20% from 2021 to 2050. Between 2021 and 2050, oil and natural gas are expected to grow by 7% and 2%, respectively, and to account for approximately 47% of the energy mix in 2050, down slightly from 53% today. In the 2022 WEO, natural gas demand declines significantly in all IEA scenarios, compared with the 2021 WEO, due primarily to a larger share of renewables in the power generation sector displacing natural gas. According to the IEA, Russia’s invasion of the Ukraine is prompting a wholesale reorientation of global energy trade, whereby the European Union compensates for the loss of Russian imports with an accelerated transition away from natural gas through a surge in renewable capacity additions (2022 WEO).

In the APS – a scenario that is back casted to meet global pledges – global energy demand is expected to remain essentially flat between 2021 and 2050 partly due to lower oil demand related to an accelerated rate of electric vehicle penetration in the automobile market, along with measures designed to slow demand, such as energy and materials efficiency. Despite these drivers, oil and natural gas are still expected to represent a third of the total energy mix in 2050.

With every passing year and the continuing increase in global emissions, it is more challenging for the world to align with the NZE pathway. In 2021, energy related carbon dioxide equivalent (CO2e) emissions rose by approximately 6%, or 2 billion tonnes, to reach 36.6 billion tonnes. This increase more than negated the emissions decrease that was witnessed globally in 2020 and was driven by rapid post pandemic economic growth, slow progress in improving energy intensity and a surge in coal demand even though renewable capacity additions reached record levels. According to the IEA, the rise in emissions to a record level is at odds with what is needed to meet countries’ Nationally Determined Contributions – the emissions reductions agreed to by individual countries under the Paris Agreement – by 2030 and their pledges to reach net zero emissions (2022 WEO). In the NZE, global energy demand is projected to decrease approximately 15% between 2021 and 2050. In 2050, renewables are projected to account for approximately 70% of the total energy mix, and oil and natural gas are projected to account for approximately 15% of the energy mix. The NZE requires unprecedented global cooperation, significant changes in government policies, technologies that currently do not exist at commercial scale and, as noted in the 2022 WEO, at least four times the current investment in clean energy.

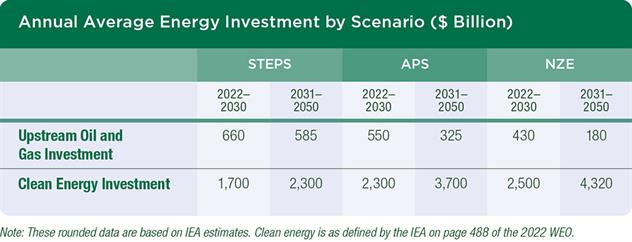

Energy Investment in the IEA’s 2022 Scenarios

In all three IEA scenarios, the world is facing a structural supply deficit in energy, and significantly more investment is required both in oil and gas and in clean energy to address the dual challenge of meeting global energy demand and reaching net zero emissions. In the NZE, investment in clean energy needs to increase to more than $4 trillion to reach net zero by 2050. Current investment in upstream oil and gas – approximately $417 billion in 2022 – is below what is required even in the NZE (see table below).

According to the IEA, “governments have not been pursuing strong enough policies to generate a much needed increase in clean energy investment. In the absence of such a surge in energy efficiency improvements and clean energy deployment, investment in the fossil fuels sector has also been falling short of what is required to meet rising demand” (p. 88). Investment in upstream oil and gas halved between 2014 and 2021, due primarily to two commodity price collapses between 2014 and 2020. The discovery of new oil resources in 2021 was at its lowest level since the 1930s. Total investment in clean energy is estimated at $1.4 trillion in 2022 and would have to double by 2030 to be consistent with the APS and quadruple in the same time period to be consistent with the NZE. As mentioned in the 2022 WEO, a significant increase in energy investment is essential to reducing the risks of future price spikes and volatility and to supporting the global ambition of achieving net zero emissions by 2050.

Hess’ Approach to Scenario Planning

The TCFD recommends that once a less than 2°C scenario is established, companies should define a base case, or business as usual outlook, for the future. The base case should use the same set of metrics as the less than 2°C scenario (e.g., oil demand, carbon prices and other market factors) and share the same fundamental economic foundations. Establishing multiple scenarios allows for measurement of the delta between metrics at future points to properly understand the envelope within which risk and opportunity may occur.

Hess’ approach to scenario planning is aligned with the TCFD recommendations. We have prepared internal guidance that details our approach and establishes a specified methodology. This also serves as a roadmap for our third party verifier to review and verify that we followed our specified methodology when conducting this scenario analysis.

Our first step in this process was to establish a Hess base case, which for 2023 was premised off a $75 per barrel Brent oil price through 2050 and a $5.00 per million British thermal units Henry Hub natural gas price through 2050; both cost bases are in 2023 real terms. In addition, in the base case, we applied either actual carbon pricing for our assets and intended forward investments (where a regulatory framework for such exists) or used a carbon price of $50 per tonne through 2050 for other geographies.

We then compared our base case against the various oil, natural gas and carbon prices in the IEA’s three key scenarios – STEPS, APS and NZE – running our current asset portfolio and intended forward investments through these varying sets of assumptions to assess financial robustness.

The charts below show the oil and natural gas prices, as well as CO2 prices in advanced economies, under the IEA’s STEPS, APS and NZE against Hess’ base case. The IEA’s oil, natural gas and CO2 prices have been adjusted to 2023 real terms to enable comparison with Hess’ base case price assumptions. As these charts show, there is a wide spread of oil, natural gas and carbon pricing across the three IEA scenarios, a key component of informed scenario planning.

Results of the Hess Scenario Planning Exercise

Through our methodology, we have tested the robustness of Hess’ asset portfolio and intended forward investments under multiple energy supply and demand scenarios, including the IEA’s STEPS, APS and NZE.

In discussing potential financial implications, the TCFD asks organizations to provide an indication of direction or ranges of potential implications. Financial implications from Hess’ scenario analysis are detailed below.

Hess’ ability to monetize our reserve base in a well below 2°C scenario is reinforced in Carbon Tracker’s report Paris Maligned (December 2022). This report assesses the production and investment plans of oil and gas producers using the IEA’s APS as the basis for being considered Paris-aligned (1.7°C by 2100). In the report (Figure 2), Hess appears to be one of the companies that is most well aligned with the APS, meaning that we can monetize our reserves in a well below 2°C scenario.

Validation of Hess Strategy

If the lower oil demand assumed in the IEA’s APS or NZE comes to fruition, industry competition will intensify, and higher cost producers may be forced out of the marketplace. Hess’ strategic priorities, which position us to deliver long term value, are to deliver (1) high return resource growth, (2) a low cost of supply and (3) industry leading cash flow growth. This strategy is consistent with the IEA’s less than 2°C scenarios, which envision a meaningful role for oil and natural gas through 2050.

Hess plans to allocate the majority of our capital expenditures to developing the company’s assets offshore Guyana and in the Bakken shale play in North Dakota. Guyana is one of the largest oil provinces discovered in the world in the last 20 years. We have had more than 30 oil and gas discoveries since 2015, with more than 11 billion barrels of oil equivalent (BOE) gross discovered recoverable resources and billions of barrels of remaining exploration potential. Our five sanctioned developments through May 2023 – Liza Phase 1, Liza Phase 2, Payara, Yellowtail and Uaru – have breakeven Brent oil prices between approximately $25 and $35 per barrel. According to a study by Wood Mackenzie (as illustrated below), Guyana is one of the highest margin, lowest carbon intensity, highest growth oil developments globally.

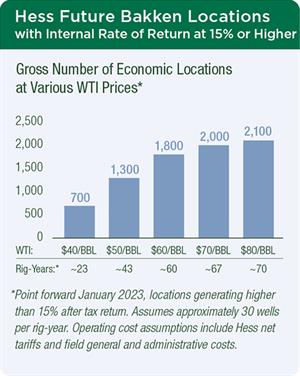

In the Bakken, Hess has approximately 700 and 1,300 locations at $40 per barrel and $50 per barrel West Texas Intermediate (WTI), respectively, that can generate at least a 15% internal rate of return. That equates to 23 to 43 rig years for the company, assuming one rig drills 30 wells per year, as illustrated below.

In the Bakken, Hess has approximately 700 and 1,300 locations at $40 per barrel and $50 per barrel West Texas Intermediate (WTI), respectively, that can generate at least a 15% internal rate of return. That equates to 23 to 43 rig years for the company, assuming one rig drills 30 wells per year, as illustrated below.

We expect that Guyana’s low breakeven costs, along with aggressive cost reduction activities in the Bakken, will contribute substantially to structurally lowering our portfolio breakeven costs to less than $50 per barrel Brent oil by 2027. Notably, this is significantly lower than the oil price assumption through 2030 in the STEPS and APS (1.7°C Paris-aligned scenario). As a result, Hess is well positioned to retain our share in the marketplace as a low cost producer, even with the gradually reducing global oil demand projected under the IEA’s various scenarios.

In summary, based on the results of our 2023 scenario planning analysis, we conclude that we can produce our current reserve base and deliver strong performance under the STEPS and APS and produce the majority of our current reserve base under the NZE.