Governance and Management Approach

Hess takes a strategic approach to managing our global tax responsibilities in a variety of ways.

We report our income on the income tax returns of the jurisdictions in which we have a substantial business presence and operations. We pay taxes on our profits in the jurisdictions where the value is created, and we do not use artificial structures or contracts to avoid establishing a tax presence in countries where we do business. Our primary business of hydrocarbon exploration, development, production, natural gas processing and marketing does not lend itself to transfer pricing techniques for shifting income from countries where we create value to lower taxed jurisdictions.

Consistent with our strategy, our tax compliance obligation in every country where we create value is to pay the right amount of tax at the right time. Hess understands that we have a social responsibility to satisfy tax obligations in the jurisdictions where we operate and that governments have the sovereign right to determine their tax policies and rates – including the right to provide tax incentives and exemptions to promote investment, employment and economic growth – and to implement tax laws accordingly. Hess takes steps to determine the intention of legislatures and aims for good faith compliance with applicable tax laws while legitimately accessing available incentives and exemptions to increase after-tax returns on investments.

Our Code of Business Conduct and Ethics applies to the Hess Tax Department. We have a compliance hotline in place for all employees to raise concerns and report instances of potential noncompliance with our values and principles without fear of retaliation.

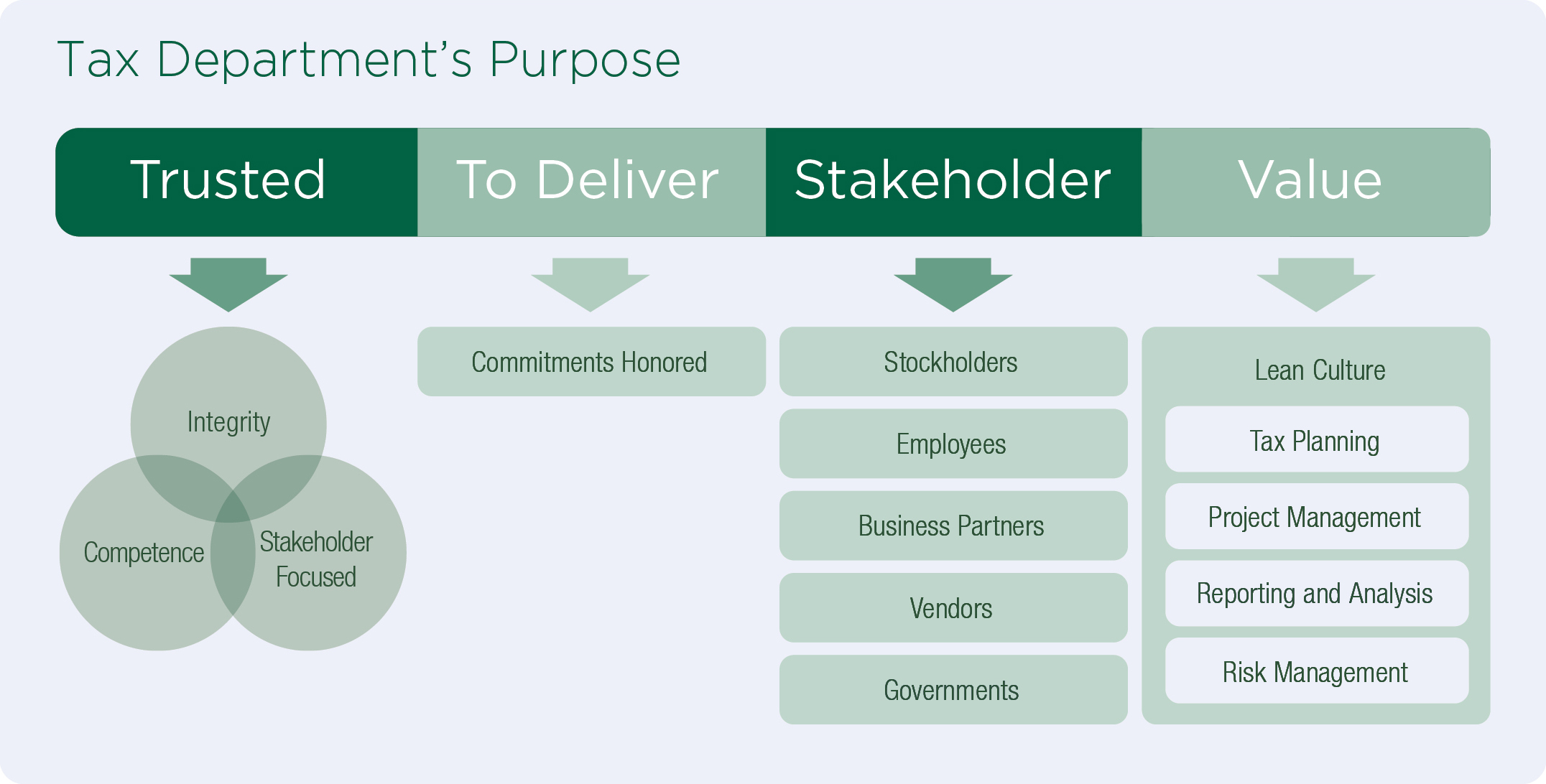

The Hess Tax Department’s purpose is to be “trusted to deliver stakeholder value.” We recognize that we have multiple stakeholders with important interests to manage and balance. Earning and keeping the trust of these stakeholders is central to our purpose, and to accomplish this objective, our Tax Department focuses on stakeholder needs with integrity and competence.

Our tax leadership comprises two Senior Directors who manage the Tax Department and report to our Chief Financial Officer (CFO). Our CFO and tax leadership update the Audit Committee of Hess’ Board of Directors on the company’s tax posture and significant tax matters periodically (and more frequently as needed); this includes briefings on the Tax Department’s policies regarding tax planning, decisions around tax return positions and financial reporting for income taxes.

The Hess Tax Planning Principles, developed with oversight from our CFO and the Board of Directors’ Audit Committee, guide our decisions on tax planning matters. Tax Department employees meet with our CFO throughout the year to reinforce our commitment to these principles.

Hess Tax Planning Principles:

- We plan around business operations and commercial transactions.

- We implement tax planning only if it has a business purpose and economic substance.

- We generally do not implement planning where the tax technical merits of our positions do not meet a “more likely than not” or higher standard of confidence.

- We do not make decisions about planning based on risk of detection of issues by tax authorities.

- We do not buy tax planning products or strategies designed by third parties.

- We use internal resources to analyze the tax consequences of transactions and engage external advisors to review our technical analyses and conclusions regarding significant items.

Risk Management and Control Framework

We carry out risk assessments before entering into tax planning on significant transactions, and our tax leadership, our CFO, external auditors and, where necessary, external subject matter experts discuss potential transactions. We employ appropriately qualified tax professionals with the right levels of expertise for their roles.

Given the range of jurisdictions in which we operate and the constant evolution of the tax laws in these various jurisdictions, we carefully monitor the possibility of emerging tax risks. We continuously work to identify, analyze and manage these risks within our broader enterprise-wide risk management and internal control frameworks. We implement risk management measures, including review processes for tax analyses, training and internal controls over tax accounting and compliance. We consult with external subject matter experts when significant uncertainty or complexity exists as an additional step in managing our tax risk. We continuously review our processes for financial reporting and tax compliance for risk of significant misstatements or omissions and evaluate our tax positions for technical uncertainties. We annually test our internal controls over these processes for design and operational effectiveness and work to remediate any deficiencies as appropriate. We engage our external auditor with candor and transparency so that tax risks receive full evaluation and proper management.

Our control framework for tax returns and disclosures builds off our internal controls for financial reporting for income taxes and layers on additional controls specific to the income tax compliance process. We believe this control framework provides an effective process for assuring the accuracy and completeness of income tax returns by providing a robust review of the data and filing positions reflected in the income tax return.

Further, as a Securities and Exchange Commission registrant, Hess is required by Section 404 of the Sarbanes/Oxley Act (SOX) to annually test the effectiveness of our internal controls, including those over financial reporting of income taxes. SOX also requires that (1) management provide its assessment of the effectiveness of the controls and (2) the company’s external auditor attest to, and report on, the assessment made by management.

Hess’ internal controls around reporting of income taxes include the following:

- Approval is required by members of management of sufficient seniority and technical capability for any significant tax return filing position that requires significant judgment.

- All material uncertain tax positions are reviewed, and the positions taken by Hess are approved by our tax leadership and CFO.

- Significant transactions that could materially impact Hess’ profit or loss and/or could materially affect the U.S. Generally Accepted Accounting Principles’ temporary differences related to taxes are reviewed by our tax leadership and other senior members of the Tax Department.

- Each quarter, reports are generated on statutory income tax rate reconciliations, rollforwards of current and deferred tax accounts, analysis of valuation allowance positions and other selected analytics that provide visibility into the financial statement assertions reflected within the general ledger income tax accounts. These reports are reviewed by our tax leadership, our CFO and external auditors.

- Multiple layers of review are built into the income tax return preparation process, as follows:

- Tax returns are generally prepared by a Big Four accounting firm.

- Tax returns are reviewed by senior Hess tax personnel, including our tax leadership, to assure the accuracy, completeness and reliability of the tax returns and related disclosures.

- The Hess U.S. consolidated tax return is also reviewed by a second Big Four accounting firm that signs the tax return as a paid preparer.

- Tax processes are continuously evaluated and adjusted if necessary.

Stakeholder Engagement

When Hess makes a decision to operate in a particular country, we seek to build long term relationships with relevant stakeholders and develop our business in a sustainable manner. We recognize our responsibility to the governments and the local communities where we operate and understand that the taxes we pay are important sources of government revenue.

We conduct tax planning with an understanding that tax is only one of the many costs to be considered when making investment decisions. We aim to balance our responsibilities to the governments of the countries in which we operate with our fiduciary duty to our shareholders to manage our total tax costs of doing business. We aim to create and protect shareholder value while managing tax risks and complying in good faith with all applicable laws in accordance with the Hess Tax Planning Principles.

We are transparent with the tax authorities in the jurisdictions in which we operate. Since the 2011 tax year, the company has been included in a select group of companies invited into the U.S. Internal Revenue Services’ (IRS) Compliance Assurance Program (CAP), widely regarded as a best practice in managing IRS audits of U.S. federal tax returns. The program is collaborative and requires proactive disclosure by the CAP taxpayer, as it is expected that the taxpayer will make open, comprehensive and contemporaneous disclosures of material issues. Hess is committed to working with the tax authorities in all jurisdictions relevant to our operations in a positive, proactive and transparent manner with the goal of minimizing disputes and reaching mutually agreeable outcomes where possible.

We participate in industry policy groups to help keep us informed on evolving legislation and to provide an avenue for educating lawmakers about our business and the role that taxes play in our investment decision making process, with a focus toward development of sustainable tax law. We engage in local, national and international dialogues with governments and business groups to support the development of effective tax systems, legislation and administration.

Country by Country Income Tax Reporting

Hess discloses tax information for each tax jurisdiction in which we operate or have a resident entity on an annual basis, including income tax payments and income tax expenses, within the framework of its legal obligations to the IRS (country by country reporting). The U.S. tax authorities share Hess’ disclosures with countries that have signed agreements allowing for that exchange.

Country by country income tax reporting (2020–2024)